Home Insurance Coverage USA is a sort of property insurance that protects a private residence. It is also sometimes referred to as homeowner’s insurance, or HOI in the US real estate sector.

Table of Contents

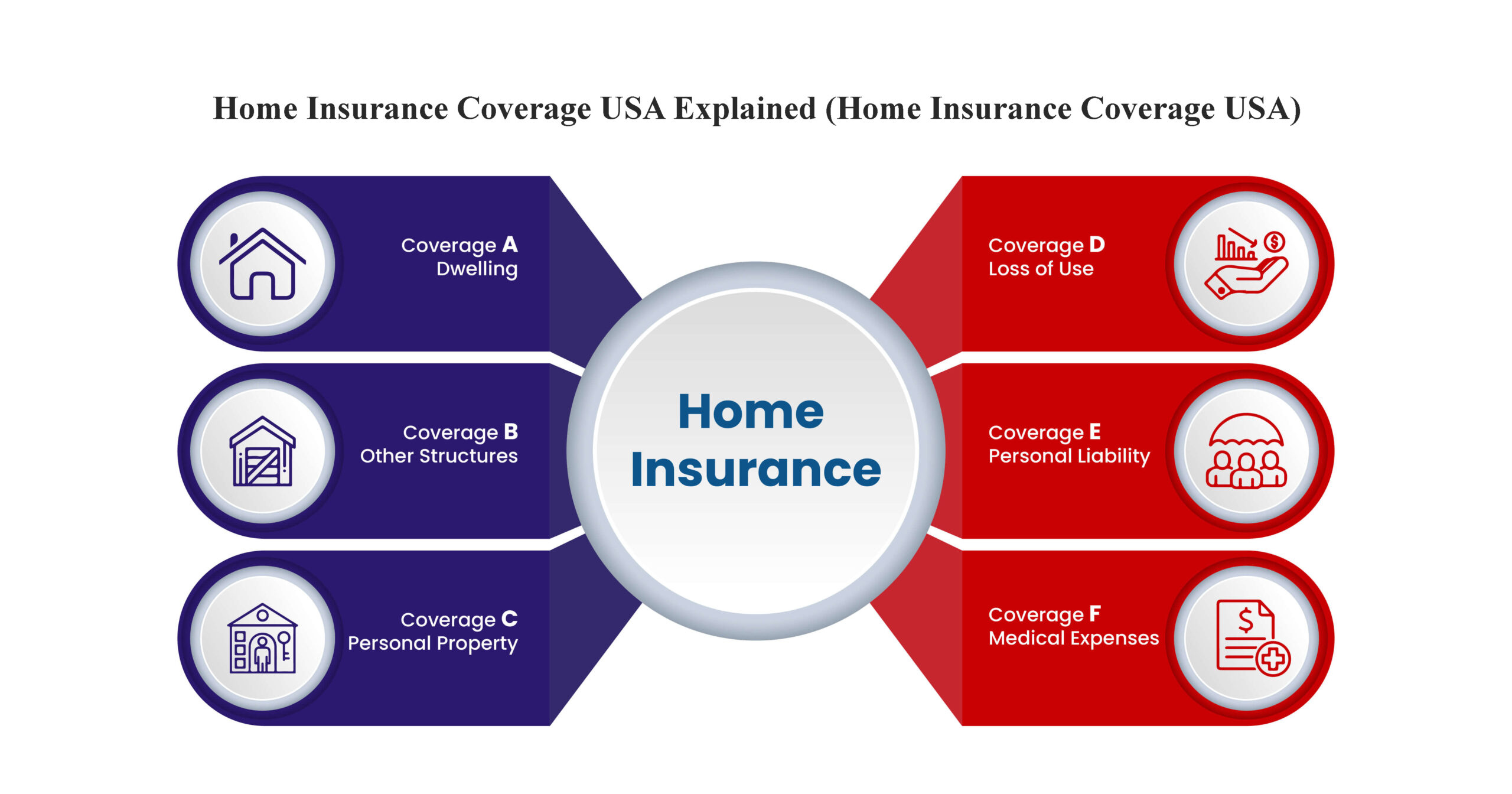

It is an industry policy that combines various personal insurance protections, which can include losses occurring to one’s home, its content loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

Additionally, home insurance coverage USA offers financial security in the event of unexpected disasters. Generally speaking, a conventional policy covers both your home’s structure and your personal possessions.

________________________________________

Why Home Insurance Is Important in the USA

Homeowners insurance plays a vital role by providing both financial protection and peace of mind. Home insurance coverage USA ensures that homeowners can protect their most valuable assets from unpredictable risks. Below are the main reasons why having it is so important:

1.Protection Against Property Damage:

Coverage for home insurance USA provides coverage for damage to your house and personal belongings brought on by a variety of hazards, including theft, vandalism, hail, storms, and fire. This means if your home gets damaged or your belongings are destroyed or stolen, your insurance can help cover the costs to repair or replace them.

2.Liability Coverage:

It provides liability coverage in case someone is injured while on your property or if you (or a family member, including pets) accidentally injure someone or damage their property. It can cover legal fees, medical bills, and awarded damages, protecting your assets from lawsuits under home insurance coverage USA.

3.Meeting Mortgage Obligations:

The majority of mortgage lenders mandate home insurance coverage USA as part of the loan agreement. This condition protects your financial interest in the property as well as theirs. Failings to maintain coverage could result in a violation of your mortgage terms.

4.Peace of Mind:

Having home insurance coverage USA offers peace of mind, knowing that you are financially protected against unforeseen events that could otherwise be devastating. It allows you to rebuild and recover without the overwhelming financial burden that significant property damage or legal liabilities can bring.

5.Coverage for Additional Living Expenses:

If your home is rendered uninhabitable by a covered event, home insurance coverage USA can help by covering additional living expenses (ALE). This includes the cost of temporary accommodation, meals, and other necessary expenses while your home is being repaired or rebuilt.

6.Protection of Equity:

Your home is likely one of your most significant investments, and it’s essential to protect its value. Home insurance coverage USA helps safeguard the equity you’ve built up in your home, ensuring that you won’t have to start from scratch financially if disaster strikes.

7.Required by Homeowners Associations (HOAs):

If you live in a community governed by a homeowner association, you may be required to maintain a specific level of home insurance coverage USA.

This ensures that all properties are adequately protected and helps preserve the overall value and stability of the neighborhood.

In essence, home insurance coverage USA is a fundamental aspect of responsible home ownership. It ensures that you are not left alone to handle the financial repercussions of unpredictable events like natural disasters, theft, or accidents on your property.

By shifting the financial burden to your insurance provider, you can concentrate on recovery and rebuilding your home after an unfortunate event.

________________________________________

Types of Home Insurance Policies in the USA

There are eight different types of house insurance coverage policies available in the United States. Your home type and whether you rent or own will determine which style is ideal for you.

- HO-1: The simplest and least comprehensive type of homeowners insurance for single-family houses, this type is rarely provided by insurers nowadays and excludes coverage for personal property.

- HO-2: An improvement over a HO-1 policy, this type of policy does cover personal property, but it generally provides fewer financial protections than a HO-3 policy.

- The most popular homeowner insurance plan for single-family homes is HO-3, which provides more comprehensive financial protection for your property and possessions against a greater variety of hazards.

- HO-4: Also referred to as renter insurance, this form of policy covers liability, personal property, and loss of use for tenants.

- HO-5: The most comprehensive coverage is offered by this policy type, which is quite comprehensive (and costly) for single-family houses.

- HO-6: This policy, created especially for condo owners, covers personal belongings and the interior structure, including the studs.

- HO-7: Designed for mobile and manufactured home owners, this policy type provides coverage for non-permanent structures that is comparable to that of a HO-3 policy.

- HO-8: This coverage type is specifically designed for older or historic homes and can be used when rebuilding a property would cost more than its market worth.

What’s Not Covered by Standard Home Insurance?

Homeowners insurance provides financial protection against damage or loss to your home caused by covered events. It generally includes coverage for your home’s structure, personal possessions, and liability in case someone is injured on your property.

However, the exact coverage details can differ depending on your policy. Let’s explore some examples of what is and isn’t typically included in a homeowners insurance plan.

KEY TAKEAWAYS:

- Most homeowner insurance covers certain basics, but policies vary, so read the fine print before you purchase one.

- Your homeowner insurance coverage may overlap with other types of insurance.

- Before coverage of your home’s structure and contents begins, all policies have deductibles Typically, coverage includes damage or destruction brought on by fire, vandalism, and some natural disasters. If someone is hurt on your property, you are also liable.

- Certain catastrophes, like flooding or earthquakes, are generally not covered by basic homeowner policies and require specialized insurance.

How to Choose the Right Home Insurance Policy:

Selecting the right home insurance policy involves more than just comparing prices — it’s about finding coverage that truly meets your needs. Start by evaluating the value of your home and personal belongings to determine how much coverage you need.

Next, compare different policy types and review what’s included and excluded in each. Pay close attention to deductibles, coverage limits, and optional add-ons, such as flood or earthquake insurance, which are often not included in standard plans.

It’s important to check the insurer’s credibility, customer support quality, and how efficiently they handle claims before choosing a policy. Comparing quotes from several providers can also help you find the ideal balance between affordability and coverage.

Lastly, make sure to review your home insurance policy each year to confirm it still reflects any changes in your home’s value, renovations, or newly purchased belongings. Having the right coverage in place ensures lasting peace of mind and solid protection for your home and valuables.

How to save money on your home insurance

1. Compare home insurance policies

Every policy is different so it can help to shop around to find the best deal. Keep in mind – value for money isn’t just about price. You need to make sure you have enough cover for your need

2. Combine buildings and contents cover

You can buy building and content over separately, or as a joint policy from one insurance company.

Homeowners are more likely to need both buildings and contents cover. Compared to having separate insurance, you can frequently save money by removing these as a joint policy.

3. Improve Home Security

Installing burglar alarms, smoke detectors, deadbolts, or CCTV cameras can reduce your premium because these devices lower the risk of theft or fire.

4. Increase Your Deductible

Opting for a higher deductible (the amount you pay before insurance kicks in) usually lowers your monthly premium. Just make sure you can afford the deductible amount if you need to file a claim.

5. Build an emergency fund

An emergency fund is money you save and put aside to cover an unexpected expense. Having savings to fall back on could help you pay for smaller repairs and reduce the need to borrow money or claim on your insurance.

6. Maintain and protect your home

For your house insurance to be valid, you frequently need to keep your property maintained and protected. In the long term, it can save you money by lowering the likelihood that you will need to file a claim on your house insurance.

The Role of Homeowners Associations (HOAs) in Insurance

A particular kind of insurance called HOA insurance is intended to safeguard homeowner associations and its members. It includes the HOA’s owned and maintained common areas, including clubhouses, playgrounds, swimming pools, sidewalks, and other shared amenities.

The insurance policy typically provides coverage for property damage, liability risks, and even legal expenses arising from disputes involving the HOA. Individual homeowner insurance, which protects a homeowner’s private property, personal responsibility, and personal items within their own unit, is not the same as HOA insurance.

Instead, HOA insurance focuses on protecting shared areas and the association itself from financial losses. In order to protect their assets, carry out their fiduciary obligations to homeowners, and adhere to legal requirements, HOAs must have adequate insurance coverage.

Why Home Insurance Is Essential for Every Homeowner

Home insurance is a vital safety net that protects one of your most valuable assets — your home. Unexpected events like fires, storms, theft, or accidents can cause major financial strain without proper coverage.

A reliable home insurance policy helps you recover from these setbacks by covering repair or replacement costs and offering liability protection if someone is injured on your property. Beyond financial security, it provides a sense of stability and confidence, ensuring that you and your family are protected no matter what challenges arise.

Conclusion:

Home insurance coverage in the USA is more than just a financial safeguard — it’s a crucial part of responsible homeownership. With the right policy, you can protect your home, belongings, and personal liability from unexpected events such as fire, theft, or natural disasters.

Understanding the types of coverage available, what’s included, and what isn’t helps you make informed decisions that suit your lifestyle and budget. Ultimately, a well-chosen home insurance policy offers peace of mind, ensuring that your home and family remain secure no matter what life brings your way.